Discuss the critical role that financial information plays in business decision-making. Identify and explain five qualitative characteristics of good financial information (such as relevance, reliability, comparability, understandability, and timeliness)

| BTM4FUB Fundamentals of Business Finance |

BTM4FUB Assignment 2 Brief 2026

| Programme: | Business & Tourism Management | ||

| Level: | Level 4 | Module Title: | Fundamentals of Business Finance |

| Module code: | BTM4FUB | Module leader/s: | Man Sheung Lam / James Mburu / Naveed Shah |

| Assignment No: | 2 | Assignment Type: | Written Report |

| Assignment weighting %: | 50% | Assignment Word Count: (or equivalent) | 1,500 |

| Penalties | All penalties that are listed at the end of this document in the Table of Penalties. | ||

Module 6 Fundamentals of Business Finance Individual Written Report

Submission Deadlines

| Summative Deadline | BTM4FUB_JUN24: Individual Report – First submission | Global Banking School Friday, 13th February 2026 before 14:00 |

| Late Submission | BTM4FUB_JUN24: Individual Report – Late submission | Global Banking School Tuesday, 17th February 2026 before 14:00 |

| Resubmission | BTM4FUB_JUN24: Individual Report – Resubmission 1 | Global Banking School Monday, 7th April 2026 before 14:00 |

| Grade & Feedback release Dates | All Grade and Feedback release dates are 21 days after the submission date. If an assignment deadline is Monday 1st 2:00pm then the grade release date will be Monday 22nd 2:00pm |

Module Learning Outcomes

| This assignment has been designed to provide you with an opportunity to demonstrate your achievement of the following module learning outcomes: | |

| Module Outcome 2 | Understand and explain the purposes of the financial information produced by businesses. |

| Module Outcome 3 | Explain the structure and terms used within the main financial statements and undertake the analysis and interpretation of financial statements. |

Assignment Requirements

Overview

This individual report assesses your ability to interpret and analyse financial information, a critical skill for informed business planning and decision-making. Set within the realistic scenario of your role as a Business Planning Assistant at Echo Journeys, you will compile a report for senior management. This task requires you to demonstrate your understanding of the purpose and characteristics of financial information, explain key accounting concepts, and apply ratio analysis techniques to evaluate the company’s performance, thereby providing a solid foundation for strategic recommendations.

Assignment task/s to be completed

You are required to write a 1,500-word report to the Operations Manager of Echo Journeys. The report must be professionally presented and address the following areas in a coherent, narrative style:

Importance and Quality of Financial Information: Discuss the critical role that financial information plays in business decision-making. Identify and explain five qualitative characteristics of good financial information (such as relevance, reliability, comparability, understandability, and timeliness). Elaborate on how these characteristics meet the needs of different stakeholders, including management, investors, creditors, and regulatory bodies, supporting your discussion with relevant examples.

Key Accounting Concepts: Define and explain the following fundamental accounting concepts, providing clear examples to illustrate their meaning and application within a tourism business context:

- Revenues, Cost of Services, Gross Profit, and Operating Profit.

- Assets, Liabilities, and Owner’s Equity.

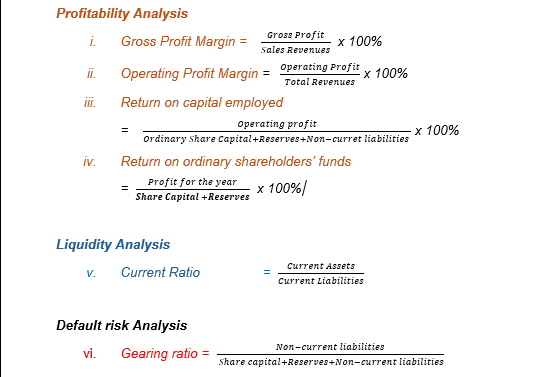

Financial Ratio Analysis (Atrill & McLaney, 2018):

Using the financial statements provided for Echo Journeys (2022-2024), calculate the following ratios and interpret the company’s performance development over this period:

- Profitability:Gross Profit Margin, Operating Profit Margin, Return on Capital Employed (ROCE) and Return on Ordinary Shareholders’ Funds.

- Liquidity:Current Ratio.

- Default Risk:Gearing Ratio.

Your analysis should not merely present the calculations but should interpret what the trends indicate about the company’s financial health and performance.

Limitations of Analysis: Conclude your financial evaluation by discussing the inherent limitations of using ratio analysis to assess a company’s performance, demonstrating a criticall understanding of the tool’s boundaries.

References

You must provide a complete reference list for all direct and indirect citations, including those for text, images, graphs, and tables. A minimum of 10 different sources is required, and you must adhere to the CCCU Harvard Referencing Guide available on Moodle.

Additional Information required to support completing the Tasks Above

This Assignment will be Anonymously marked.

No Front Sheet is to be submitted, or student name or student ID is to appear anywhere in your assignment submission as it will be anonymously marked.

- Echo Journeys

- Statement of Profit and Loss Account

- (Income Statement)

- for the year ended on 31st December

| 2022 | 2023 | 2024 | |

| £’000 | £’000 | £’000 | |

| Sales Revenues | 8,630 | 9,493 | 11,240 |

| Cost of Services | (5,005) | (5,316) | (5,395) |

| Gross profit | 3,625 | 4,177 | 5,845 |

| Administrative Expenses | (705) | (875) | (1,586) |

| Marketing Expenses | (1,254) | (1,043) | (982) |

| Depreciation | (630) | (740) | (804) |

| Operating profit (EBIT) | 1,036 | 1,519 | 2,473 |

| Interest Expenses | (68) | (72) | (108) |

| Profit before tax | 968 | 1,447 | 2,365 |

| Corporate Tax | (194) | (289) | (473) |

| Profit for the year | 774 | 1,158 | 1,892 |

- Echo Journeys

- Statement of Financial Position

- (Balance Sheet)

- as on 31st December (figures are £ ,000)

| 2022 | 2023 | 2024 | |

| £’000 | £’000 | £’000 | |

| Non-current Assets | |||

| Property, Plant and Equipment | 30,147 | 40,522 | 60,887 |

| Current Assets | |||

| Trade Receivables | 2,110 | 2,650 | 3,340 |

| Cash at Bank | 630 | 580 | 720 |

| Total Current Assets | 2,740 | 3,230 | 4,060 |

| Total assets | 32,887 | 43,752 | 64,947 |

| Equity and Liabilities | |||

| Ordinary Share Capital | 6,800 | 6,800 | 6,800 |

| Retained Profits | 8,682 | 11,869 | 14,220 |

| Total Equity | 15,482 | 18,669 | 21,020 |

| Non-Current Liabilities | |||

| Long term debts | 14,291 | 21,916 | 40,804 |

| Current Liabilities | |||

| Short term debts | 2,280 | 2,305 | 2,203 |

| Trade Payables | 834 | 862 | 920 |

| Total Current Liabilities | 3,114 | 3,167 | 3,123 |

| Total Equity and liabilities | 32,887 | 43,752 | 64,947 |

Recommended and Core Sources for Research

| Referencing Style | CCCU Harvard Referencing Style. |

| Recommended and Core Sources for Research | Atrill, P and McLaney, E.J. (2018) Accounting and Finance for Non-Specialists. 11th edition. Harlow: Pearson Education. Atrill, P and McLaney, E. J. (2018) Financial accounting for decision makers. 9th edition. Harlow: Pearson Education. Weetman, P. (2019) Financial Accounting. 8th edition. Harlow: Pearson Education. McLaney, E. (2009) Business Finance: Theory and Practice. 8th edition. Harlow: Pearson Education. Watson, D. and Head, A. (2019) Corporate finance: principles and practice. Harlow: Pearson Education. Brealey, R.A., Myers, S.C., Allen, F. and Mohanty, P. (2012) Principles of corporate finance. Tata McGraw-Hill Education |

Format of your submission and how your assignment will be assessed

This assignment should be submitted electronically via Moodle (module tutors will discuss this process with you during class time).

You must submit your work in Microsoft WORD document format.

- You can submit your work as many times as you like before the submission date. If you do submit your work more than once, your earlier submission will be replaced by the most recent version.

- Once you have submitted your work, you will receive a digital receipt as proof of submission, which will be sent to your forwarded e-mail address (provided you have set this up). Please keep this receipt for future reference, along with the original electronic copy of your assignment.

- You are reminded of the on academic misconduct, which can be viewed by following the links at the end of this document. In submitting your assignment, you are acknowledging that you have read and understood these regulations.

- It is the complete and sole responsibility of the student to upload their assessment to Turnitin for Marking prior to the specified deadline. Students should not request lecturers or SST’s to submit assessments on their behalf as they are unable to do so.

- To avoid uploading issues, students should aim to upload their assessment several hours prior to the deadline to avoid Turnitin issues around the deadline time or accidentally submitting to the wrong submission link. It is recommended to check that the assessment that has been uploaded is able to be read after you have uploaded it and if not to re-upload it. Contact the SST on your campus if you have any issues.

- Any assessment submitted after the specified deadline will incur a late penalty as specified in CCCU Academic regulations unless prior approval has been granted for Exceptional Circumstances.

Your work will be assessed on the extent to which it demonstrates your achievement of the stated learning outcomes for this assignment (see above) and against other key criteria, as defined in the grading descriptors. If it is appropriate to the format of your assignment and subject area, a proportion of your marks will also depend on your use of academic referencing conventions.

The assignment will be assessed against the specified rubric as uploaded to Moodle.

Marking Scheme / Rubric – The Marking Scheme (otherwise known as a rubric) is available on the Module Assessment Tab on Moodle.

Submission Requirements

| Submission Platform | This assignment should be submitted electronically using Moodle to the Module Submission link |

| Submission Date &Time | All submission & resubmission dates and time are as stated at the beginning of this Assignment brief. You should submit your Assignment for all deadlines earlier than 2:00pm on the date stated. Late submissions can be accepted for Summative Submissions only up to a maximum of 2 working days after the submission deadline. This does not apply to resubmission deadlines. A 10-mark deduction will be made by CCCU for all late submissions. Work submitted more than two working days after the deadline will not be accepted and will be recorded as a non-submission. Assignments submitted to the Resubmissions deadlines will be capped at 40 by CCCU. If you are affected by events which are unexpected, outside your control and short-term in nature (i.e. lasting one to two weeks), under the exceptional circumstances procedure you may be eligible for: Self-Certification – A seven day extension to your coursework. Students are allowed a maximum of 2 self-certification request per academic year can be requested. Please note that Examinations and time-constrained test are not eligible for the seven day self-certification request. Extenuating Circumstances – A 14 day extension to your coursework but there must be evidence to support the request. |