GreenTech Innovations Ltd. is a small-to-medium enterprise (SME) based in the UK, specializing in renewable energy solutions. The company has been operational for five years and is looking to expand its operations. GreenTech is consider

ACCT11046 Corporate Finance T2 Assignment Brief

Case Study

Note that the information provided is based on a fictitious company

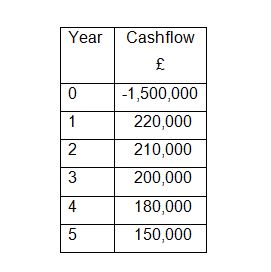

GreenTech Innovations Ltd. is a small-to-medium enterprise (SME) based in the UK, specializing in renewable energy solutions. The company has been operational for five years and is looking to expand its operations. GreenTech is considering various funding options to support its growth and is also exploring potential investments in new technologies. Additionally, the company is interested in understanding the principles of Islamic finance as it plans to enter markets in the Middle East. GreenTech has also conducted market research and estimated the following cashflows for the investment:

The cost of capital for this project is 12%, in line with the risk of the investment.

Corporation tax is 30% and capital allowances rate is 25%. Depreciation is on a straight-line basis.

You are required to:

Prepare a formal report to the Board of Directors of GreenTech. The report should analyse the following:

1. Critically evaluate different techniques and strategies for obtaining funding, including lease financing and Islamic financing.

Instructions:

- Analyse the advantages and disadvantages of debt financing for GreenTech Innovations Ltd.

- Evaluate the benefits and challenges of equity financing for the company.

- Discuss the role of lease financing and its applicability to GreenTech.

- Explore the principles and benefits of Islamic financing for GreenTech’s expansion into Middle Eastern markets.

- Compare and contrast at least two different funding strategies that GreenTech could consider.

- Provide real-world examples or case studies to support your evaluation.

Are You Looking ACCT11046 Assignment for an Answer of This Question

2. Critically evaluate the unique financial needs and considerations of small and medium-sized enterprises (SMEs).

Instructions:

- Identify and discuss the specific financial challenges faced by GreenTech Innovations Ltd. as an SME.

- Explore the financial management practices that are crucial for the sustainability and growth of SMEs.

- Compare the financial needs of GreenTech with those of larger enterprises.

- Use case studies or examples to illustrate your points.

3. Critically apply various investment appraisal techniques to make informed decisions about potential investments.

Instructions:

- Explain at least three investment appraisal techniques

- Apply these techniques to the cashflows for GreenTech Innovations Ltd.

- Critically analyse the results and make a recommendation based on your appraisal.

- Discuss the limitations and advantages of each technique used.

This coursework maps to learning objective

L3. Critically evaluate and understand different techniques and strategies for obtaining funding, including debt and equity financing options.

L4. Critically evaluate the unique financial needs and considerations of small and medium-sized enterprises and Islamic finance.

L5. Critically apply various investment appraisal techniques to make informed decisions about potential investments